Millrose's Spinoff: Letting Go of the Ugly

Splitting up the capital intensive side of a good business.

Lennar (LEN) is one of the largest homebuilders in the United States. With 80,000 homes delivered in FY 2024, $36 billion in revenue, a $33 billion market cap as of this writing, and more than 71 years of history, Lennar is one of the best-regarded companies in the US. On February 7th, 2025, they will spin off their land holding division, Millrose (MRP), as a REIT. Each Lennar shareholder will receive 1 share of MRP for every 2 shares of LEN.

To better understand the spinoff and the future relationship between the firms, it's important to understand the process homebuilders go through to develop a community. There are 4 main steps to developing a housing community: 1. Identifying the lot 2. Entitlements 3. Horizontal development 4. Vertical development.

Identifying the lot: a homebuilder will identify a lot where they think building a community is profitable. Often, large homebuilders buy huge tracts of land in a city’s perimeter, where there is the most growth. Here in central Florida, cities like Clermont or St. Cloud are prime examples.

"Land east of Flagg and Monyash, aerial 2015" by David P. Howard is licensed under CC BY-SA 2.0 via Wikimedia Commons. Source.

Entitlements: Once a lot is identified, the homebuilder has to ensure that they are allowed to make their project happen on that specific site. This involves confirming or amending zoning restrictions and obtaining all building permits, approvals, and submitting plans. This process ranges from lengthy and tedious to impossible depending on the jurisdiction. In some areas, it might take 6 months, while in others it may never happen.

Horizontal development: This is the infrastructure aspect of building homes; this includes the installation of electricity, sewer, water, roads, sidewalks, common areas, pools, and other recreational facilities.

"Countryside Housing Development" by Mat Fascione is licensed under CC BY-SA 2.0 via Wikimedia Commons. Source.

Vertical development: This is the final part of the development process, the actual building of the house itself. At this point, everything else in the community should be completed; in some communities, people start moving in while other homes are being built.

This whole process is capital intensive, with a lot of cash and resources used before any monetization can be received. Here is an illustration of that cycle:

For a traditional home builder, capital will be tied for many years, even a decade, before monetizing the site. In recent decades there’s been a push for homebuilders to adopt a “capital-light” model, where homebuilders secure land by paying option deposits, usually 5% of the total price, go through entitlements if needed, proceed with the horizontal development, and then purchase the land when there are pre-sales recorded. With this system, the homebuilders tremendously lower the amount of capital invested and transfer the risk of economic conditions changing to the landowner. This system has been famously adopted by NVR and partially by Lennar.

After the spinoff, Lennar will have Millrose as a partner who will take over the capital-intensive aspect of the business, providing financing up until vertical development. While Lennar will come with their capital only when sites are pre-sold and ready for vertical development. This will significantly lower Lennar’s requirements for capital employed and lower their development risk. Millrose will also be able to partner with other home builders, but I’m going to refer only to Lennar to make things easier.

What will Lennar’s role be?

Lennar will make the site selection decisions. They will use their resources and make the decisions on where new communities will be built.

Lennar will perform all the necessary work to get entitlements and confirm the zoning.

Lennar will perform all the horizontal development.

Lennar will perform all the vertical development

What will Millrose’s role be?

Millrose will acquire the sites that Lennar chooses, only vetting them to make sure they meet Lennar’s pre-determined criteria.

Millrose will provide financing to complete any necessary entitlements and horizontal development.

What will a typical development look like?

Lennar will choose a site. On the S-11, Millrose confirms that about 81% of the sites will have entitlements and permits ready for development to commence, and further land acquisitions are preferred to have entitlements in place.

Millrose will acquire the site, and Lennar will pay a 5% option payment for the right, but not the obligation, to acquire the land in the future.

Lennar will start with the horizontal development, or entitlements if needed. Millrose will provide all the financing necessary for this step to be completed.

When horizontal development is done and the site is ready for vertical development, Lennar will exercise its option to acquire the site, paying the remaining 95%. Homes will be pre-sold or sold. Millrose will get their money back, with no profit or capital gains.

As you can see, Millrose will serve as a financing vehicle for Lennar, and they will charge interest on the value of the homesites. For the first 12 months after the spinoff, the interest rate will be set at 8.5%, but then it will hover between 7-10% depending on the interest rates prevailing at the time.

Lennar will perform all the work, and Millrose will come in when cash is needed. Here I’ve adjusted the previous illustration to show who will put up the cash at each step:

What are the risks for Millrose?

Lennar may not exercise its option to buy the sites; they can give up on a project and leave Millrose with unfinished developments. To counter this risk, if Lennar decides to give up on a project, they will be cross-terminated with other communities. The cross-termination agreements involve pools of between $25-50 million in option value, meaning $500 million to $1 billion in development value. So Lennar cannot cherry-pick developments to give up, but they are still protected in the case of a nationwide economic downturn, or if a specific pool is full of bad developments, Millrose will bear this risk. If a pool is given up, Millrose can make Lennar finish the homesites and provide their resources to sell the homes, but this will be on Millrose’s wallet, and if the development is unsuccessful, losses will be assumed by MRP.

How will Millrose make money?

Millrose will charge Lennar interest on the total capital invested in land acquisition and horizontal development. On the expense side, Millrose will be managed by Kennedy Lewis Land and Residential Advisors (KL). KL will make sure the sites acquired by Millrose meet their criteria; they will make sure both parties comply with the agreements and compliance with REIT regulations. KL will not make any site selection decisions; they will only vet the sites to make sure they are feasible. For this work, KL will charge 1.25% of the total tangible assets for the first 12 months and 1.25% of tangible assets less cash afterward.

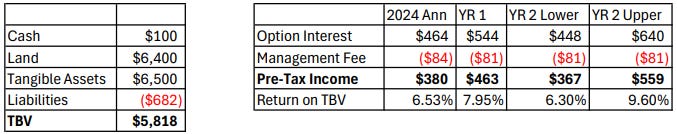

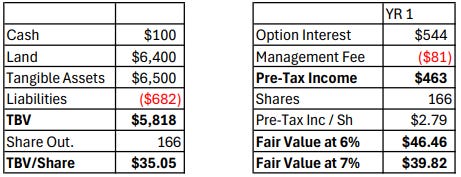

This is my estimate of Millrose’s balance sheet and income statement:

Millrose is expected to receive between $5-6 billion in homesites plus $1 billion in cash, of which $900 million will be used to acquire homesites from Rausch Coleman, a homebuilder that will be acquired by Lennar simultaneously with the spinoff, leaving about $100 million in cash. This means that Millrose will own between $5.9 and $6.9 billion of homesites, for which they’ll get an 8.5% interest in the first year, and they’ll pay KL management fees of 1.25% of that amount plus the $100 in cash. The S-11 doesn’t specify what liabilities Millrose has but states $682 million in pro forma liabilities, which I’ve used for my projections.

How much is Millrose worth?

I believe Millrose resembles a revolving credit facility (RCF). But this quirky RFC is non-recourse, meaning that Lennar can give up some of their cross-collateralized pools in case there is a bad economic downturn, just as many office REITs are doing with their non-recourse debt-loaded office buildings. Right now Lennar has an RFC with JPMorgan for $2.8 billion, which charges SOFR + 1%-1.625% depending on the leverage ratio. Right now this means an interest of between 5.4% and 6%. For a sanity check, I also reviewed their bonds due 2027, and they trade below a 5% yield to maturity. So 6% seems to be a reasonable yield.

As of December 31st, 2024, there were ~265.5 million LEN shares outstanding; this means they will distribute ~132.8 million shares of MRP to shareholders. LEN will keep a 20% stake in MRP, which they state: “Lennar expects to dispose of this stock through a subsequent spin-off, split-off, public offering, private sale or any combination of these potential transactions.” So the total number of shares will be ~166 million.

While my rough estimate of “fair value” is currently above tangible book value per share, I would be extremely cautious to buy shares above book value. Why?

If Lennar decided to give up on all of the sites, the liquidation value of the sites would be substantially lower than the book value, simply because the sites are projected to not be profitable.

During the first year, the interest charged is fixed at 8.5%, then it will float. If general interest rates go down, MRP’s income will go down; if rates go up, MRP’s income will increase. This implies that, if nothing goes wrong, MRP should be worth around book value. The exceptions would be a widespread economic downturn where Lennar gives up on many sites or a situation where interest rates skyrocket and 10% is a very low upper band.

Millrose is allowed to borrow money to partner with additional homebuilders; their debt-to-equity limit is 1:1, so in theory, they could boost their returns on equity by borrowing money at lower interest rates than what they are charging. But that is not something I will count on.

Where is the opportunity?

On February 6th, MRP’s “When Issued” stock closed at $22.99 per share, which is 65% of book value and a projected 12% net twelve months pre-tax yield. But, Lennar estimates that ~30% of their shares are held by index funds, and many of them may be forced to sell their Millrose shares after the spinoff; this might create enough selling pressure to send the stock to very low levels and create an opportunity for some investors to make a profit.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. It does not constitute a recommendation to buy, sell, or hold any securities. Always conduct your own research or consult with a licensed financial advisor before making any investment decisions.