I just bumped into another interesting Japanese net-net that is adopting shareholder-friendly measures:

55% of NCAV

7x earnings

100% of the market cap in cash

Dividend increase

First repurchase

While I’ve been able to find dozens of cheap Japanese companies, there aren’t many that are being proactive in closing the gap to TBV and dirt cheap. However, I consider Showa Paxxs (TYO:3953) to have a solid balance sheet, a stable business, a cheap valuation, and it is starting to change its capital allocation policy.

What does Showa Paxxs do?

Showa Paxxs (3954) is a provider of packaging for different industries. Their main line of business is packaging for heavy products such as rice, wheat, salt, and sugar, as well as cement and other products. It is a classic boring business that can be sustainable if run correctly. Here are a few examples from their website:

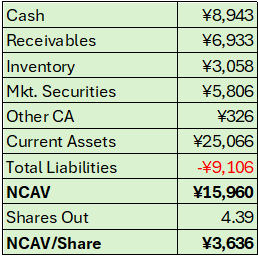

Balance Sheet

As usual, the first thing I try to look for is a big discount between market value and asset value, and then make sure the asset value isn’t likely to be impaired. Showa Paxxs has ¥8.9 billion in cash and ¥5.8 billion in marketable securities, which make up almost 60% of current assets, while inventory only makes up 12% of current assets, so most of their current assets have low risk of impairment. When looking at a net-net, I like the current ratio to be over 2, because it allows for the possibility of some impairment in those current assets. For 3954, the current ratio is 2.75x, with most current assets having low risk of impairment.

Business

Showa Paxxs’ business has been very stable in the last 10 years. Revenue has hovered between ¥20 and ¥25 billion. Operating income between ¥1 and ¥1.5 billion, and net income between ¥0.8 and ¥1.3 billion. As I said before, it is a very stable and boring business that is likely to keep going for a few decades. The company was founded in 1935, and considering their solid balance sheet and stable business, I think it is not crazy to think the business will be around for many years.

Valuation

At the moment of this writing, 3954 trades for ¥1,985, which equates to 55% of NCAV and 38% of tangible book value. The trailing twelve months' EPS is ¥301 for a 6.6 p/e ratio, and with ¥273 per share expected for the next twelve months, we get a 7.3 forward p/e ratio.

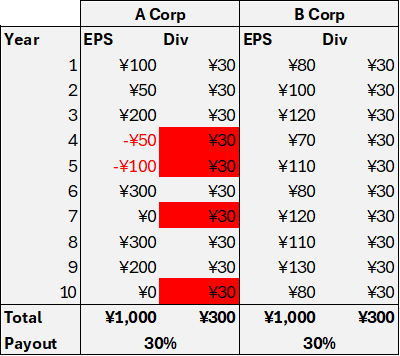

It is always easier to deal with a business that’s very stable in its revenue and earnings, but in the case of Japan, it might be an additional advantage with the current push to improve capital allocation. Many Japanese companies have adopted a minimum payout ratio of their earnings in dividends, and it is common to see a minimum earnings payout ratio of 30%, 40%, or 45%. This means that the companies will declare dividends per share of at least that stated percentage of earnings. If a business has stable profitability, not only will the dividends per share be stable, but the company can set a higher payout ratio, because earnings will not fluctuate as much to cause a dip into reserves to pay the dividend, at least not often. Let’s picture it:

Now I ask you, if you were CFO of both corporations, would you be comfortable setting the same dividend policy for A Corp as for B Corp? Most of us will say no, even if we set a 30% payout ratio “no matter what”, for A Corp; shareholders will not be pleased to see dividends go to nothing for a few years and then skyrocket in others. Naturally, it's easier to set a dividend policy for Corporation B. I bet most of us wouldn’t be too bothered to set even a ¥50 dividend.

Capital Allocation

While the company hasn’t laid out a clear plan to improve capital allocation, management has taken steps in the right direction. After 6 years of keeping the dividend about the same, 3954 is increasing dividends from ¥40 to ¥50 per share in FY 2026. And they conducted the first share repurchase in March. Although only 1.35% of the shares outstanding were bought back, it is definitely the right step in capital allocation for Showa shareholders.

As I stated in my previous Japanese net-net write-up, one metric I look at is tangible book value per share growth. It helps me get a better idea of the company's condition; if TBV is compounding at an acceptable rate, it shows that management has not invested shareholders’ capital into worthless ventures or sunk excess profits into low-return businesses. In the case of Showa, TBV per share has compounded at 7% in the last 10 years, and 7.6% in the last 5 years, all this while paying dividends.

How might this investment go wrong?

I do not have any special insight into the business. I do not know if management are crooks or if the business will become obsolete.

Management might not act shareholder-friendly. This year’s capital allocation improvement might be a one-time event, and nothing further will be done. This might result in Showa becoming a value trap.

Often, we (investors) take Japanese companies with these metrics lightly, but finding a stable company with 100% of the market cap in cash, at 6-8x earnings, with improving capital allocation, and that is a net-net is almost insane. Taking a basket approach to Japanese net-nets, I believe the odds of this investment being satisfactory are good.

Long Showa Paxxs (3954). I hold it as a part of a larger basket of Japanese net-nets with similar characteristics.

Nice summary! Thanks for the write up